Nigeria crypto market: What’s legal, what’s risky, and where to trade in 2025

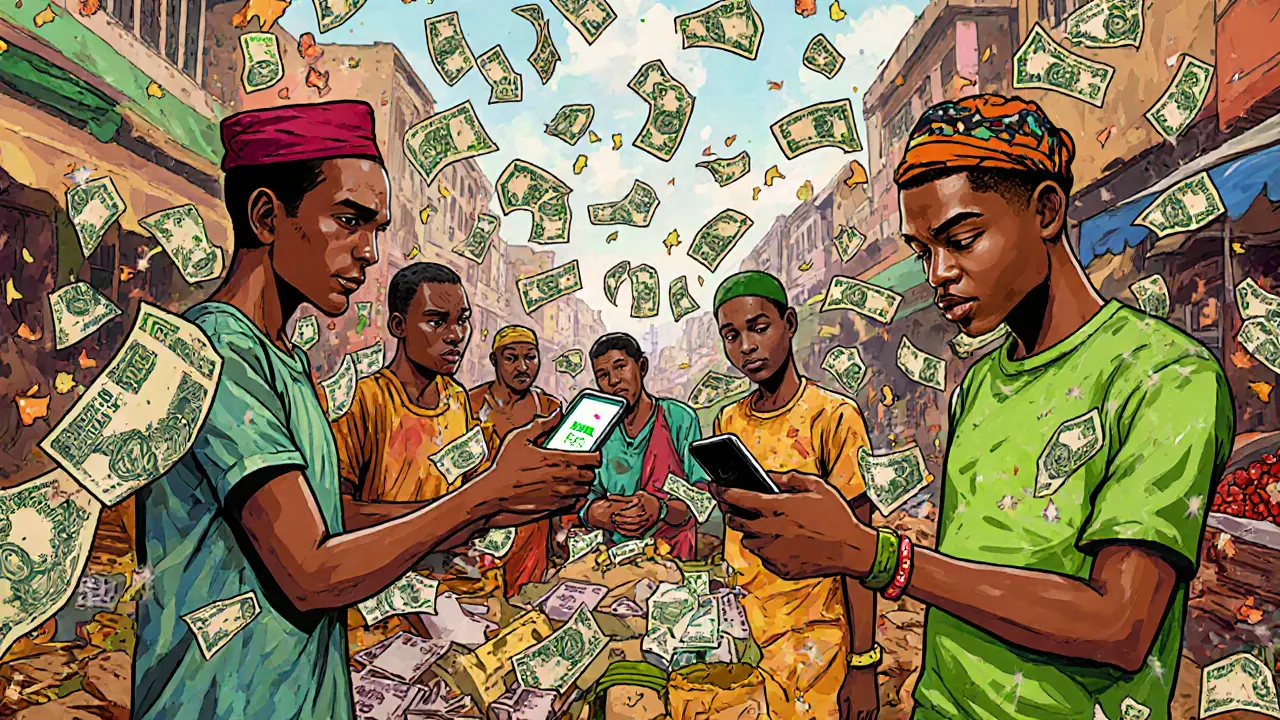

When you talk about the Nigeria crypto market, the rapidly growing but tightly regulated ecosystem where millions of Nigerians buy, sell, and hold digital assets despite banking restrictions. Also known as Nigerian cryptocurrency scene, it’s one of the most active in Africa—not because of loose rules, but because people found ways to work around them. The Central Bank of Nigeria banned banks from handling crypto transactions back in 2021, but that didn’t stop adoption. It just pushed users toward peer-to-peer trading, licensed exchanges, and mobile wallets. Today, the game has changed again. In 2025, the Securities and Exchange Commission (SEC) of Nigeria requires every crypto exchange operating in the country to be officially licensed. That’s not a suggestion—it’s the law.

That’s why Quidax, a fully licensed Nigerian crypto exchange that complies with SEC regulations and offers Naira deposits, withdrawals, and local customer support. Also known as Nigeria’s top regulated crypto platform, it’s one of the only two exchanges cleared to operate legally. The other is Busha, a homegrown platform that’s been vetted by Nigerian regulators and supports direct bank transfers in Naira. Also known as Nigeria’s trusted crypto gateway, it’s built for everyday users who want to trade without fear of frozen accounts. If you’re using any other exchange—like Bybit, KuCoin, or Binance—your funds are at risk. The SEC has already frozen accounts and seized assets from unlicensed platforms. This isn’t theoretical. Real people lost money because they trusted platforms that looked legit but had no legal backing.

The Nigeria crypto market isn’t about hype anymore. It’s about survival. People aren’t just trading Bitcoin or Ethereum—they’re using crypto to send money to family abroad, protect savings from inflation, and access global markets without waiting for banks. But the rules are clear: if you’re not on the approved list, you’re playing with fire. You might get lucky for a while, but one day, your wallet could vanish overnight. The licensed exchanges aren’t perfect, but they offer legal protection, audit trails, and recourse if something goes wrong. That’s more than you can say for the rest.

Below, you’ll find real stories and warnings from traders who’ve been burned, guides on how to verify if an exchange is licensed, and breakdowns of the platforms that actually work under Nigeria’s 2025 rules. No fluff. No guesses. Just what you need to stay safe and keep trading without losing everything.

Crypto Adoption in Nigeria: How Economic Pressure Is Driving Mass Adoption Despite Restrictions

- 5 Comments

- Jan, 8 2025

Nigeria leads global crypto adoption as millions use Bitcoin and stablecoins to survive inflation, bypass banking restrictions, and send remittances. With $59B in transactions and 22 million users, crypto is no longer optional-it’s essential.