SEC Nigeria: How Crypto Regulation Is Shaping Nigeria’s Digital Finance Future

When you hear SEC Nigeria, the Securities and Exchange Commission of Nigeria, the government body tasked with overseeing financial markets including digital assets. It’s not just a regulator—it’s the gatekeeper trying to control a financial revolution it didn’t start. While banks froze accounts and traditional finance failed millions, Nigerians turned to Bitcoin, USDT, and peer-to-peer trading to pay for food, send remittances, and save money. Now, the SEC Nigeria is playing catch-up, banning unregistered platforms, warning about fake airdrops, and trying to force crypto firms into compliance. But here’s the twist: the more they crack down, the more people use crypto.

Crypto adoption in Nigeria, the highest in Africa and among the top globally, driven by economic pressure, not tech hype. It’s not about speculation—it’s survival. With over 22 million users and $59 billion in transactions, crypto isn’t a trend. It’s infrastructure. And SEC Nigeria knows it. They’ve shut down exchanges like Binance Nigeria, fined platforms without licenses, and pushed for KYC rules. But they can’t stop people from using P2P apps or sending crypto through Telegram. The real battle isn’t about legality—it’s about control. Meanwhile, crypto scams thrive in the gray zone. Fake airdrops like TRO and SUNI lure users with promises of free tokens, while sketchy exchanges like BitxEX and DubiEx vanish with deposits. The SEC Nigeria warns about them—but most users learn the hard way.

What you’ll find here isn’t just news. It’s a map. You’ll see how SEC Nigeria policies affect real people, how scams exploit regulatory gaps, and which crypto projects actually have value amid the noise. From exchange reviews that expose risky platforms to deep dives on stablecoins and on-chain metrics, this collection cuts through the hype. You’ll learn what’s safe, what’s a trap, and how to protect yourself when the rules are still being written. This isn’t about waiting for permission. It’s about understanding the battlefield—and winning on your terms.

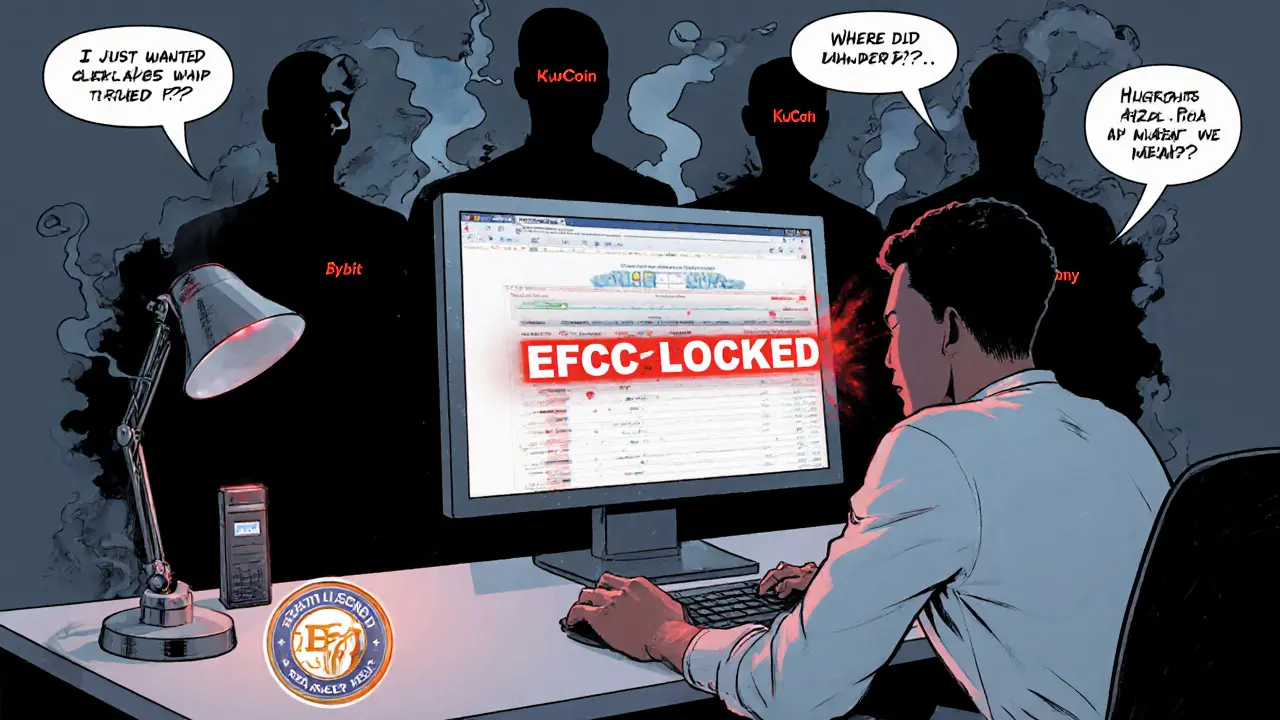

Crypto Exchanges to Avoid if You Are Nigerian in 2025

- 5 Comments

- Jun, 11 2025

In 2025, Nigeria requires all crypto exchanges to be licensed by the SEC. Only Quidax and Busha are approved. Using unlicensed platforms like Bybit or KuCoin risks account freezes, asset seizure, and lost funds. Know the rules before you trade.