Crypto Exchange 2025: Best Platforms, Regulations, and What to Avoid

When you're trading crypto in 2025, your crypto exchange, a platform where you buy, sell, or swap digital assets. Also known as cryptocurrency trading platform, it's no longer just about low fees or flashy interfaces—it's about compliance, security, and whether the exchange actually lets you get your money out. The best exchanges in 2025 aren’t the ones with the most memes or the loudest ads. They’re the ones that follow the law, have real customer support, and don’t vanish when markets dip.

That’s why Buda crypto exchange, a regulated platform popular in Latin America for trading in local currencies like Chilean pesos and Colombian pesos stands out. It doesn’t pretend to be global—it knows its users, handles local banking, and keeps withdrawals fast. Meanwhile, LaserSwap, a decentralized exchange built on the Base blockchain serves a different crowd: traders chasing early-stage memecoins with low fees and quick swaps. But it’s not for beginners. If you’re not watching your positions, you can lose money fast.

And then there are the ones you should walk away from. BKEX exchange, a platform with repeated user reports of failed withdrawals and unresponsive support is a red flag. No amount of “bonus airdrops” or “$8 free coins” makes up for the risk of losing your entire balance. In 2025, regulators in the U.S., Europe, and Asia are cracking down hard. Exchanges that ignore rules get banned. Users get stuck. That’s why you need to know what’s legal where.

Where crypto exchanges stand in 2025

Crypto regulation isn’t a threat anymore—it’s the baseline. In Cyprus, traders use only CySEC-licensed exchanges under MiCA rules. In Latin America, exchanges like Buda thrive because they play by local banking laws. In China? Accepting crypto as payment is a criminal offense. Even in places like Georgia, where owning crypto is tax-free, running an exchange or ATM requires a license. If an exchange doesn’t mention its regulatory status, it’s not trustworthy.

Trading volume dropped nearly 28% in early 2025—not because people lost interest, but because unregulated platforms got shut down. Users moved to compliant exchanges. Tokens got delisted. The market cleaned up. What’s left are exchanges that can prove they’re real: audited, licensed, and transparent. You don’t need a fancy app. You need a platform that won’t disappear when you need your cash the most.

Below, you’ll find real reviews of exchanges that actually work in 2025, deep dives into the ones you should avoid, and breakdowns of how new rules are shaping what’s possible. No fluff. No promises of free coins. Just what you need to know before you trade.

HYDRA Dex Crypto Exchange Review: Is This Decentralized Exchange Worth Trying?

- 9 Comments

- Jul, 20 2025

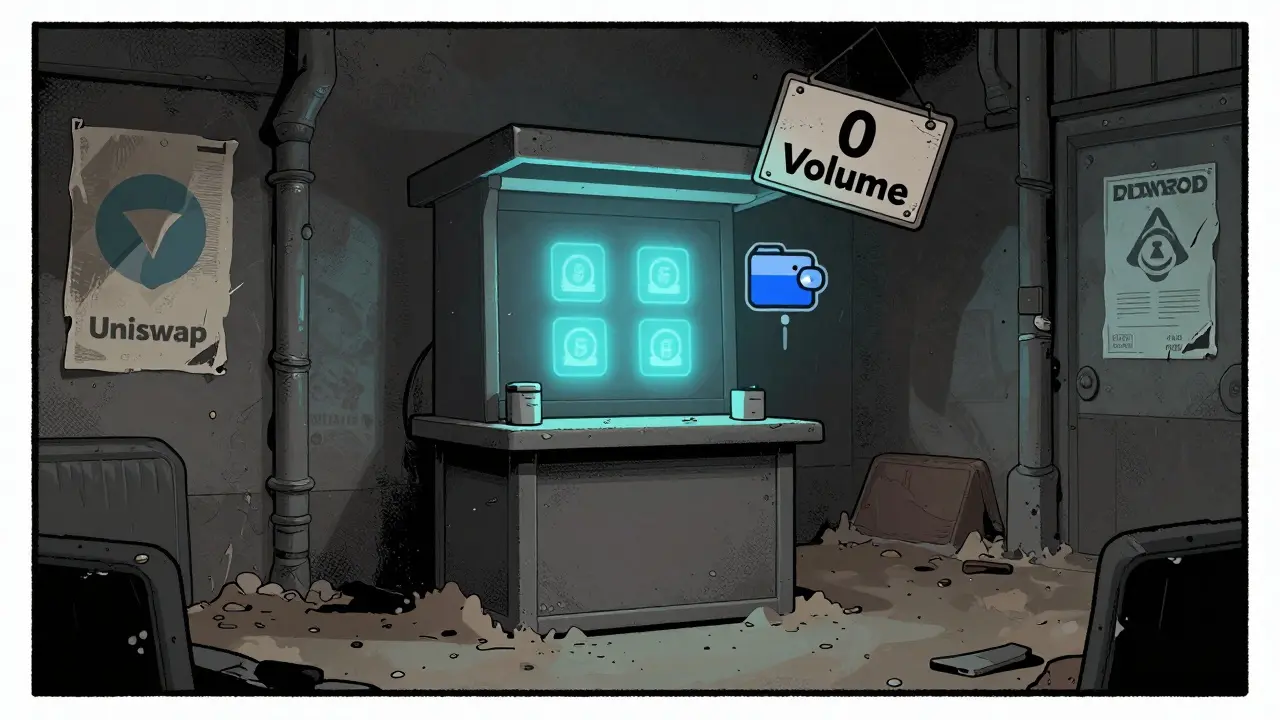

HYDRA Dex is a decentralized exchange with zero trading volume, four listed tokens, and no community. Despite its innovative fee-sharing model, it's effectively dead in 2025. Here's why you should avoid it.