Crypto Mining: How It Works, Where It’s Banned, and What’s Really Happening

When you hear crypto mining, the process of validating blockchain transactions and earning new coins as a reward. Also known as Bitcoin mining, it’s the backbone of decentralized networks like Bitcoin and Ethereum Classic—but it’s also one of the most regulated, controversial, and changing parts of crypto today. It’s not just about running computers. It’s about electricity, geography, laws, and who controls the power grid. In Venezuela, the government runs mining through a state agency called SUNACRIP, using cheap power but facing blackouts and corruption. In China, mining was outright banned in 2021, and any remaining operations were seized or shut down. Meanwhile, in Nigeria and parts of Latin America, people mine to survive inflation, not for profit.

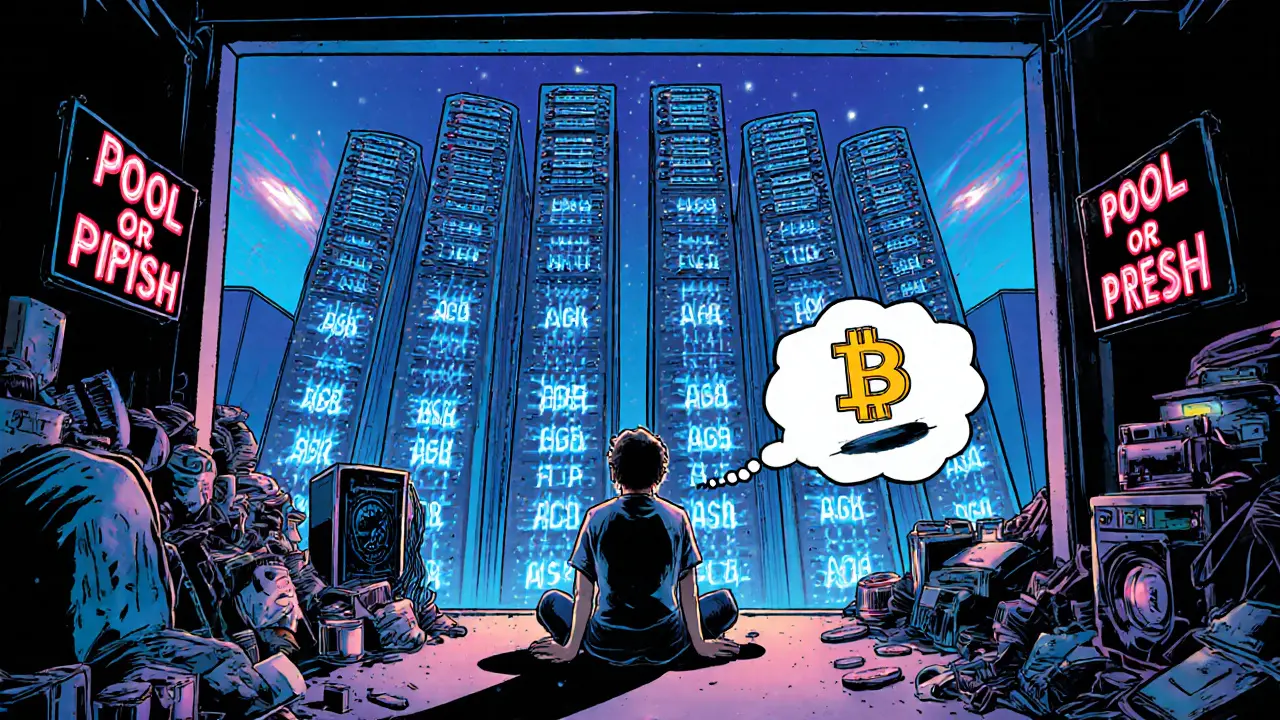

Crypto regulations, government rules that dictate who can mine, where, and under what conditions have turned mining from a hobby into a legal minefield. Some countries tax mining income. Others ban it entirely. A few, like El Salvador, encourage it by offering free electricity. But here’s the truth: most home miners today lose money after paying for power and hardware. The days of mining Bitcoin on a gaming PC are over. You need industrial-scale operations, access to cheap renewable energy, and the legal permission to run them. That’s why the real action isn’t in basements anymore—it’s in data centers in Texas, Kazakhstan, or underground in Venezuela.

Mining hardware, specialized machines built to solve cryptographic puzzles faster than regular computers has become a high-stakes investment. ASIC miners cost thousands, use as much power as a small fridge, and last maybe two years before they’re obsolete. If you’re still using a GPU for Bitcoin mining, you’re likely losing money. But for altcoins like Monero or Ravencoin, GPUs still make sense. And that’s where things get messy—some projects pretend to be mining-friendly but are really just scams. You’ll find posts here that expose fake mining coins, shady exchanges pretending to offer mining rewards, and even airdrops tied to mining scams. Not everything labeled "mining" is real.

What you’ll find below isn’t a list of how-to guides. It’s a reality check. We’ve collected posts that show you where mining still works, where it’s been crushed by law, and where people are pretending it’s alive just to take your money. You’ll read about Venezuela’s chaotic state-run system, China’s total ban, and why Nigerian users turn to crypto not just to trade—but to survive. You’ll see how exchange inflows and outflows reflect miner behavior, and why some "mining" tokens are dead before they even launch. This isn’t about getting rich quick. It’s about understanding who really controls the chain—and who’s just selling you the shovel.

Future of Mining Pool Industry: How Bitcoin Pools Are Evolving in 2025 and Beyond

- 9 Comments

- Oct, 2 2025

In 2025, mining pools are the only way to profitably mine Bitcoin. Discover how Neopool, ViaBTC, and F2Pool are leading the industry with smarter tech, lower fees, and new features like staking and AI-driven optimization.