Unlicensed Crypto: Risks, Scams, and What to Avoid

When you hear unlicensed crypto, a cryptocurrency service operating without legal authorization or regulatory oversight. Also known as unregulated crypto, it often refers to exchanges, tokens, or platforms that avoid government scrutiny—but that’s exactly why they’re dangerous. There’s no safety net. No insurance. No way to file a complaint if your funds vanish. Unlike licensed platforms like HashKey Exchange, which follow Hong Kong’s strict rules and offer user protection, unlicensed crypto thrives in the shadows—where scams grow fast and disappear faster.

Most unregulated crypto exchange, a platform that lets users trade digital assets without being registered with any financial authority. Also known as unlicensed exchange, it typically hides behind vague terms, fake traffic numbers, and promises of free crypto airdrops. Look at BitxEX or DubiEx—both claim to offer low fees or free tokens, but neither has security audits, user reviews, or any proof they can return your money. These aren’t startups. They’re traps. And they’re everywhere. The same goes for tokens like TRO or PKG—no team, no roadmap, no legitimacy. Just a ticker symbol and a social media post promising riches. These are the kinds of projects that thrive in unlicensed crypto ecosystems because there’s no one checking their work.

Why does this matter? Because crypto scam, a deceptive scheme designed to steal crypto assets under false pretenses. Also known as crypto fraud, it relies on trust, urgency, and ignorance. If it sounds too good to be true—free $8 coins, no-deposit bonuses, guaranteed returns—it is. Scammers know people are tired of high fees and complex platforms. They use that frustration to lure you in. Meanwhile, legitimate projects like CAD Coin (CADC) or Tinyman work openly, with clear documentation, regulated backing, and real users. You don’t need to chase the wild west to make crypto work for you.

The truth is simple: if a crypto platform doesn’t say where it’s licensed, it’s not safe. If it doesn’t show audits, user feedback, or team details, it’s hiding something. And if you’re being pushed to act fast or told you’ll miss out, you’re already in a scam. The posts below show you exactly what unlicensed crypto looks like in practice—from fake airdrops to dead tokens to exchanges with zero credibility. You’ll see real examples of what to avoid, and why some platforms earn trust while others vanish overnight. This isn’t theory. It’s a warning list written in lost funds.

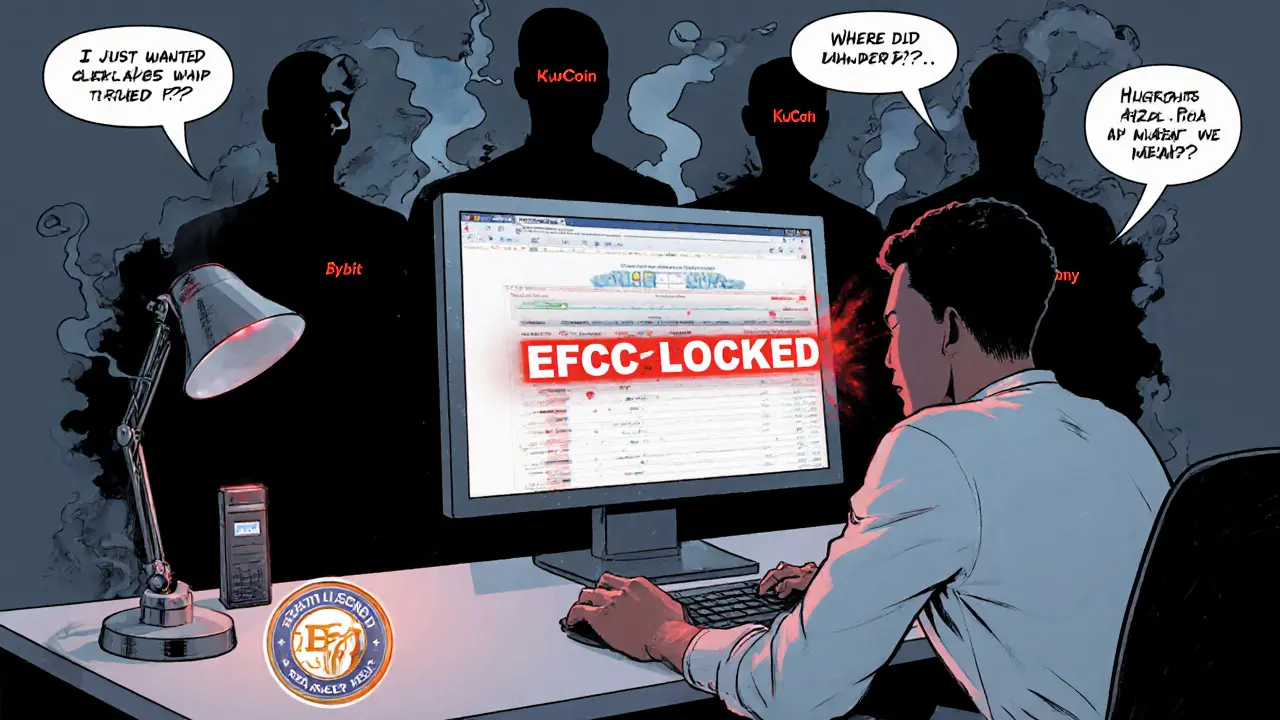

Crypto Exchanges to Avoid if You Are Nigerian in 2025

- 5 Comments

- Jun, 11 2025

In 2025, Nigeria requires all crypto exchanges to be licensed by the SEC. Only Quidax and Busha are approved. Using unlicensed platforms like Bybit or KuCoin risks account freezes, asset seizure, and lost funds. Know the rules before you trade.