Crypto News in February 2025: Bitcoin, Ethereum, and Airdrop Updates

When tracking cryptocurrency news, real-time updates on digital assets, market shifts, and blockchain developments that impact investors and users. Also known as crypto updates, it’s what keeps traders, developers, and everyday users one step ahead in a market that never sleeps. February 2025 was anything but quiet. Bitcoin hit a new high after a major institutional buy-in, Ethereum rolled out its long-awaited fee reduction upgrade, and over a dozen new airdrops dropped—some with real value, others with red flags.

One of the biggest stories was the Bitcoin, the original cryptocurrency, often used as digital gold and a store of value. Also known as BTC, it surged past $72,000 after a U.S. ETF saw record inflows. This wasn’t just speculation—it was real money moving in. Meanwhile, Ethereum, the leading smart contract platform powering DeFi, NFTs, and dApps. Also known as ETH, it cut transaction costs by 40% with its latest network tweak. That change didn’t just help devs—it made swapping tokens cheaper for regular users too. And if you were watching for airdrops, February delivered. Projects like LayerZero, ZKSync, and a surprise token from a major exchange gave away free tokens to wallet holders. Some were worth $50. Others? Worthless. We sorted the real ones from the spam.

What you’ll find in this archive isn’t just headlines. It’s the kind of stuff that actually matters: how Bitcoin’s move affected altcoins, which airdrops were legit and how to claim them, what Ethereum’s upgrade meant for your wallet, and why a small DeFi protocol suddenly exploded in activity. No fluff. No hype. Just what happened, why it mattered, and what you should do next.

What is Powsche (POWSCHE) crypto coin? The Porsche meme coin explained

- 7 Comments

- Feb, 26 2025

Powsche (POWSCHE) is a Solana-based meme coin built on the 'Need money for Porsche?' internet joke. It has no utility, no team, and no value beyond speculation. Here's what you need to know before buying.

State Control of Crypto Mining in Venezuela: How the Government Manages and Limits Digital Mining

- 6 Comments

- Feb, 24 2025

Venezuela's state-controlled crypto mining system uses cheap electricity and strict regulations to manage digital mining - but corruption, power outages, and public distrust have made it chaotic. Despite bans and bureaucracy, mining continues underground.

How Ethereum Hard Forks Upgrade the Network

- 10 Comments

- Feb, 19 2025

Ethereum hard forks are critical upgrades that break old rules to fix security flaws, reduce fees, and switch to greener consensus. Learn how The Merge and EIP-1559 transformed the network-and why future forks are unavoidable.

Can Businesses in China Accept Crypto Legally in 2025?

- 5 Comments

- Feb, 16 2025

As of 2025, businesses in mainland China cannot legally accept any cryptocurrency. It's a criminal offense to receive Bitcoin, Ethereum, or any digital asset as payment. The only legal digital currency is the state-backed digital yuan.

Chinese Government Crypto Seizures and Enforcement Actions: The Complete Ban Explained

- 6 Comments

- Feb, 15 2025

China's 2025 crypto ban made owning or trading any digital asset illegal. This is the full story of how the government eliminated crypto, seized billions in assets, and pushed the digital yuan as the only legal digital currency.

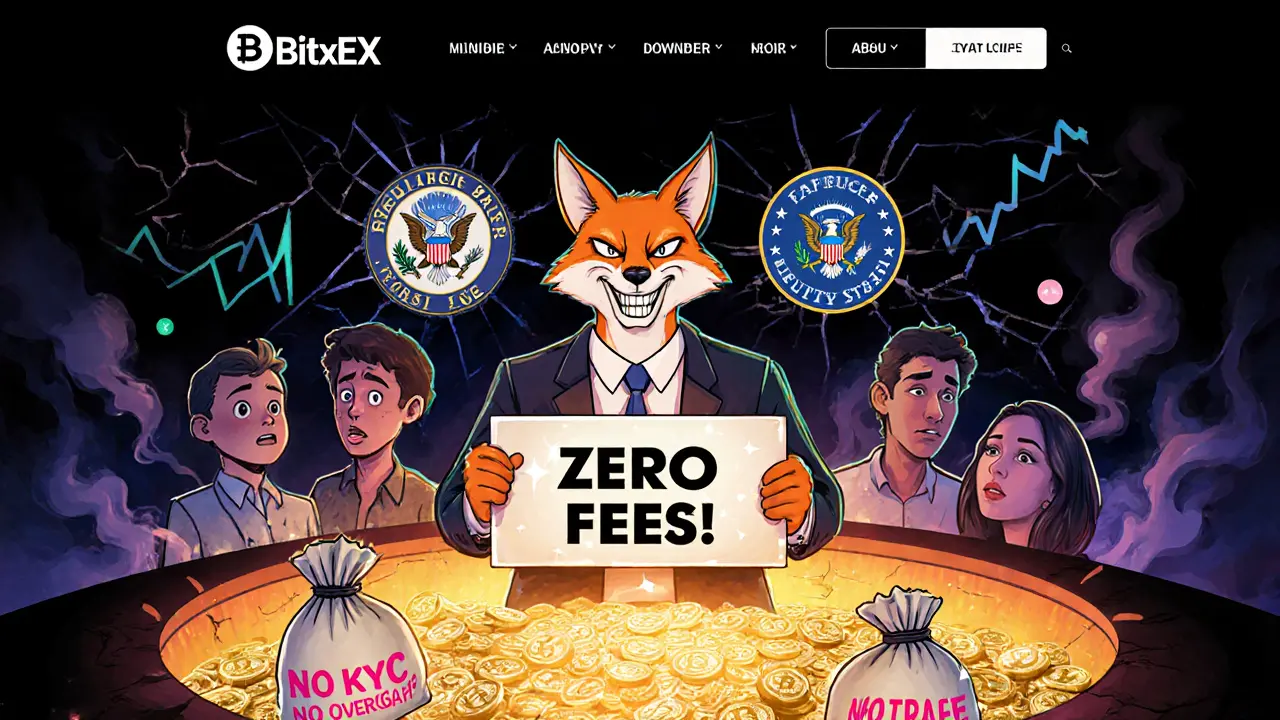

BitxEX Crypto Exchange Review: Red Flags, Scam Warning, and Safer Alternatives

- 8 Comments

- Feb, 13 2025

BitxEX is a high-risk crypto exchange with no regulatory oversight, fake traffic, and widespread withdrawal issues. Experts confirm it's a scam. Learn the red flags and find safer alternatives.

Buda Crypto Exchange Review: Best for Latin American Traders in 2025

- 9 Comments

- Feb, 6 2025

Buda is the leading crypto exchange in Chile, Colombia, Peru, and Argentina, offering direct trading in local currencies with strong security and low fees. Ideal for Latin American retail traders.

What is Quotient (XQN) crypto coin? The truth about a dead project

- 7 Comments

- Feb, 4 2025

Quotient (XQN) is a dead cryptocurrency with no development, no community, and zero trading activity since 2017. Don't invest-this is a ghost token with no future.

How to Fill Out Form 8949 for Cryptocurrency Trading in 2025

Learn how to correctly fill out Form 8949 for cryptocurrency trading in 2025. Understand what transactions count, how to calculate gains and losses, and how to avoid IRS penalties with accurate reporting.