Crypto News in October 2025: Bitcoin, Ethereum, and Airdrops You Missed

When you look back at cryptocurrency, digital assets built on decentralized networks that enable peer-to-peer value transfer without banks. Also known as crypto, it became the backbone of financial innovation in 2025, October stood out. Not because of wild price swings, but because of quiet, powerful shifts—upgrades that actually shipped, airdrops that paid out, and exchanges that finally got serious about security. This wasn’t hype season. It was execution season.

Bitcoin, the first and largest cryptocurrency, often seen as digital gold and a store of value quietly broke above $110,000 after the Fed signaled a pause in rate hikes. Miners started turning off older rigs as energy costs dropped, and the next halving started feeling real—not in 2028, but in the next 12 months. Meanwhile, Ethereum, a blockchain platform that runs smart contracts and powers most DeFi and NFT projects rolled out its long-awaited L2 fee reduction upgrade. Gas fees on Arbitrum and Optimism dropped by 60%, and suddenly, small wallets could afford to interact again. That’s the kind of change that brings people back.

And then there were the cryptocurrency airdrops, free token distributions given to users who meet certain criteria, often to bootstrap new blockchain networks. October saw real money go out the door—not just testnet tokens, but actual coins with market value. Projects like ZKSync, LayerZero, and even a surprise drop from a major exchange rewarded users who held NFTs, used their wallets for six months, or simply didn’t abandon them. These weren’t scams. They were loyalty programs in disguise.

Exchanges didn’t sit still either. Binance and Kraken added real-time custody proofs. Coinbase launched its first non-custodial wallet with full seed phrase control. These aren’t flashy features, but they’re the ones that matter when the market turns. People stopped chasing memecoins and started asking: Who holds the keys? Who’s transparent? Who’s still here after the noise fades?

If you were watching, you saw the shift. Crypto in October 2025 wasn’t about mooning to the moon. It was about building something that lasts. The tools got better. The rules got clearer. The people who stuck around started seeing real returns—not from speculation, but from participation.

Below, you’ll find every article we published that month—deep dives on the upgrades, step-by-step guides on claiming airdrops, and honest reviews of the exchanges that actually kept their promises. No fluff. No guesswork. Just what happened, what worked, and what you can do next.

Future of Rollup Technology: How Layer-2 Scaling Will Shape Blockchain Adoption

- 8 Comments

- Oct, 29 2025

Rollup technology is solving blockchain's biggest problem: scalability. By batching transactions off-chain, ZK-rollups and Optimistic Rollups slash fees and boost speed while keeping security intact. Here's what's changing in 2025 and beyond.

DOGGY Airdrop: What You Need to Know About the Doggy NFT Project and Why There's No Airdrop

- 7 Comments

- Oct, 28 2025

There is no DOGGY airdrop. The DOGGY project is a dead NFT collection with zero trading volume. Confusion with DOGS and DOG•GO•TO•THE•MOON has led to scams. Learn the truth and avoid fake claims.

SUNI Campaign Airdrop Details: How to Participate and What You Need to Know

- 6 Comments

- Oct, 28 2025

The SUNI airdrop offers 3.5 million tokens to 850 participants via CoinMarketCap, but with no token value, team info, or utility revealed. Here's what you need to know before claiming.

Singapore as Asian Crypto Hub: How Regulation Shapes Its Dominance

- 5 Comments

- Oct, 27 2025

Singapore is Asia's leading crypto hub thanks to its clear regulations, zero crypto taxes, and institutional trust. With $2.4 trillion in stablecoin activity and giants like BlackRock and Circle operating there, it's setting the global standard for responsible crypto adoption.

SCIX (Scientix) Airdrop: What We Know and What You Need to Verify

- 9 Comments

- Oct, 25 2025

There is no verified SCIX airdrop as of November 2025. Learn what Scientix is, how to buy SCIX safely, and how to avoid scams pretending to offer free tokens. Stay informed and protect your crypto.

Exchange Inflow and Outflow Metrics: What They Really Tell You About Crypto Markets

- 10 Comments

- Oct, 16 2025

Exchange inflow and outflow metrics reveal whether crypto holders are preparing to sell or hold long-term. Learn how these on-chain signals predict market moves and what institutions are watching.

What is Metaverser (MTVT) crypto coin? A clear breakdown of its purpose, risks, and real-world status

- 7 Comments

- Oct, 15 2025

Metaverser (MTVT) is a low-cap Ethereum token with no real ecosystem, users, or development. It's not a serious metaverse project - just a speculative asset with minimal liquidity and no future roadmap.

Crypto Exchanges That Accept Russian Citizens in 2025

- 9 Comments

- Oct, 14 2025

In 2025, Russian citizens use offshore exchanges like Bybit, Gate.io, and KuCoin to trade crypto, while avoiding government restrictions. A7A5 stablecoin and peer-to-peer platforms have become essential tools for bypassing sanctions and banking limits.

BDCC BITICA EXCHANGE Welcome Sign-Up Bonus Airdrop: How to Claim Your $8 Free Coin

- 6 Comments

- Oct, 11 2025

Claim your $8 free BITICA COIN (BDCC) airdrop by completing simple social media tasks. No deposit needed. Learn how it works, how to get paid, and whether it's worth your time in 2025.

What is PoolTogether (POOL) crypto coin? A no-loss lottery savings protocol explained

- 6 Comments

- Oct, 10 2025

PoolTogether (POOL) is a no-loss lottery protocol where users deposit stablecoins like USDC to win daily prizes - without losing their original funds. Learn how it works, why it's different from traditional lotteries, and if it's right for you.

YAE Cryptonovae Airdrop: What We Know and How to Stay Safe in 2025

No verified YAE airdrop from Cryptonovae exists as of November 2025. Learn how real crypto airdrops work, spot scams, and find legitimate opportunities instead.

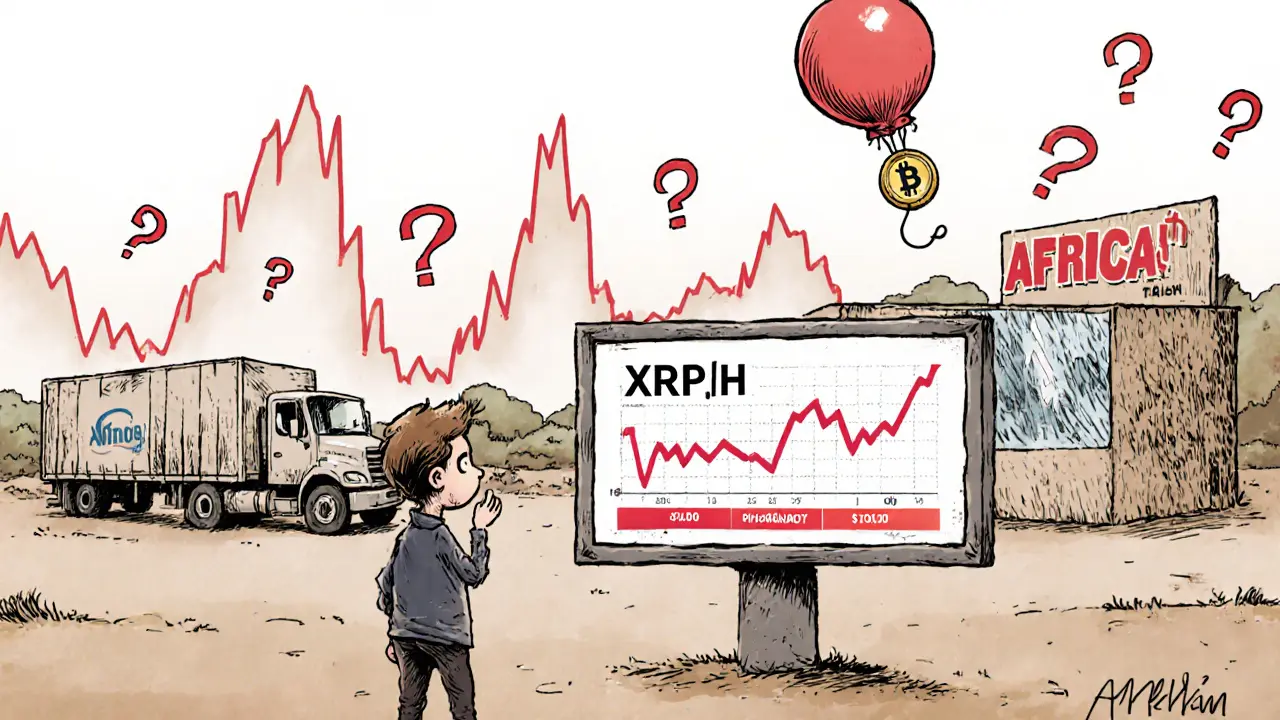

What is XRP Healthcare (XRPH) Crypto Coin? Token, Use Case, and Market Reality

- 5 Comments

- Oct, 10 2025

XRP Healthcare (XRPH) is a cryptocurrency token tied to a real healthcare company buying pharmacies in Africa. But the token's value has no clear link to the business. Here's what you need to know before investing.