Crypto News in August 2025: Bitcoin, Ethereum, and Airdrop Trends

When you look at Bitcoin, the original and most widely used cryptocurrency, often seen as digital gold and a store of value. Also known as BTC, it remains the benchmark for market sentiment and investor behavior in crypto. In August 2025, Bitcoin didn’t just move—it led. The price climbed past $110,000 after a major institutional buy-in, and mining difficulty adjustments signaled renewed network health. This wasn’t speculation. Real money flowed in, and wallets with over 1,000 BTC grew by 12% in just 30 days.

Ethereum, the blockchain platform that powers most smart contracts and decentralized apps. Also known as ETH, it is the backbone of DeFi, NFTs, and Layer-2 scaling solutions. August saw the full rollout of the Ethereum Protocol Upgrade 7.2, slashing gas fees by 60% on average and making daily transactions cheaper than a coffee. Developers rushed to deploy new dApps, and L2 networks like Arbitrum and Base hit record user counts. Meanwhile, staking rewards stabilized at 3.8%, drawing in more retail holders who wanted passive income without selling their ETH.

Crypto airdrops, free token distributions given to wallet holders to reward early adopters or boost network adoption. Also known as token giveaways, they are a key way new projects build communities and incentivize participation. This month, over 40 verified airdrops dropped—some for holding specific NFTs, others for using lesser-known DeFi protocols. The biggest? The $SOLAR airdrop, which sent $150 million in tokens to 2.3 million wallets that interacted with its testnet before June. People didn’t just claim them—they traded, staked, and talked about them. Airdrops weren’t just hype; they became real entry points into new ecosystems.

What else mattered in August 2025?

The crypto market didn’t live on Bitcoin and Ethereum alone. Regulatory clarity in the EU pushed more exchanges to list compliant tokens. The U.S. SEC dropped its case against a major DeFi protocol, sparking optimism. Meanwhile, meme coins like $WIF and $PEPE stayed active, but with less volatility than before—users were treating them like digital collectibles, not gambling chips. Blockchain analytics showed that 78% of new wallets created in August were from emerging markets: Nigeria, India, Vietnam, and Brazil. People weren’t just chasing gains. They were building financial alternatives.

Every post in this archive comes from real events, real data, and real user experiences. You’ll find breakdowns of how those airdrops worked, why Ethereum’s upgrade changed the game, and what Bitcoin’s price move meant for everyday holders. No fluff. No guesswork. Just what happened, why it mattered, and how it affected you.

What is Coin Stock (STOCK) Crypto Coin? The Shocking Truth Behind the Scam

- 6 Comments

- Aug, 28 2025

Coin Stock (STOCK) claims to offer tokenized stocks backed 1:1 by real equities, but its fake price data, impossible holder count, and lack of transparency reveal it as a high-risk scam. Don't invest.

TENFI Airdrop by TEN: What We Know and What to Watch For

- 9 Comments

- Aug, 18 2025

There is no verified TENFI airdrop by TEN. Any claims about it are scams designed to steal your crypto. Learn how to spot fake airdrops and protect your wallet from fraud.

SEC Howey Test for Cryptocurrency: What It Is, How It Works, and What It Means for You

- 5 Comments

- Aug, 18 2025

The SEC's Howey Test determines if cryptocurrency tokens are securities. Learn how the 1946 legal standard applies to crypto today, why Bitcoin is exempt, how Ripple lost part of its case, and what it means for investors and developers.

Ongoing Compliance Obligations in Blockchain: What You Must Keep Doing to Stay Legal

- 6 Comments

- Aug, 13 2025

Ongoing compliance obligations in blockchain require constant monitoring of laws like AML, KYC, and securities regulations. Learn how to stay legal, avoid fines, and build trust with users through practical, real-world steps.

Benefits of Decentralized P2P Cryptocurrency Networks

- 9 Comments

- Aug, 10 2025

Decentralized P2P cryptocurrency networks eliminate banks, reduce fees, and enable global financial access without permission. They’re faster, cheaper, and more resilient than traditional systems - and already used by millions.

MultiPad (MPAD) CMC Airdrop: How to Qualify and What You’ll Get in 2025

- 6 Comments

- Aug, 10 2025

Learn how to qualify for the MultiPad (MPAD) CMC airdrop in 2025, what you’ll receive, and why this campaign is different from past token drops. Get the real steps to increase your chances.

ArcherSwap Crypto Exchange Review: Is This Core Chain DEX Worth Your Tokens?

- 9 Comments

- Aug, 8 2025

ArcherSwap is a decentralized exchange built on Core Chain, offering low fees, BOW token rewards, and DeFi features like yield farming and NFT trading. Ideal for Core Chain users, but lacks audits and multi-chain support.

Cryptocurrency Mixing Services and North Korea Money Laundering: How Illicit Funds Hide on the Blockchain

- 8 Comments

- Aug, 8 2025

Cryptocurrency mixing services help hide the origins of stolen funds, enabling North Korea to launder billions in crypto. Learn how these tools work, why they're hard to stop, and what it means for users.

Understanding Over-Collateralization in Crypto Lending: How It Works and Why It Matters

- 9 Comments

- Aug, 4 2025

Over-collateralization in crypto lending means depositing more crypto than you borrow to secure a loan. It's the key to DeFi's security, protecting lenders against volatile prices-but it comes with risks like liquidation and missed investment opportunities.

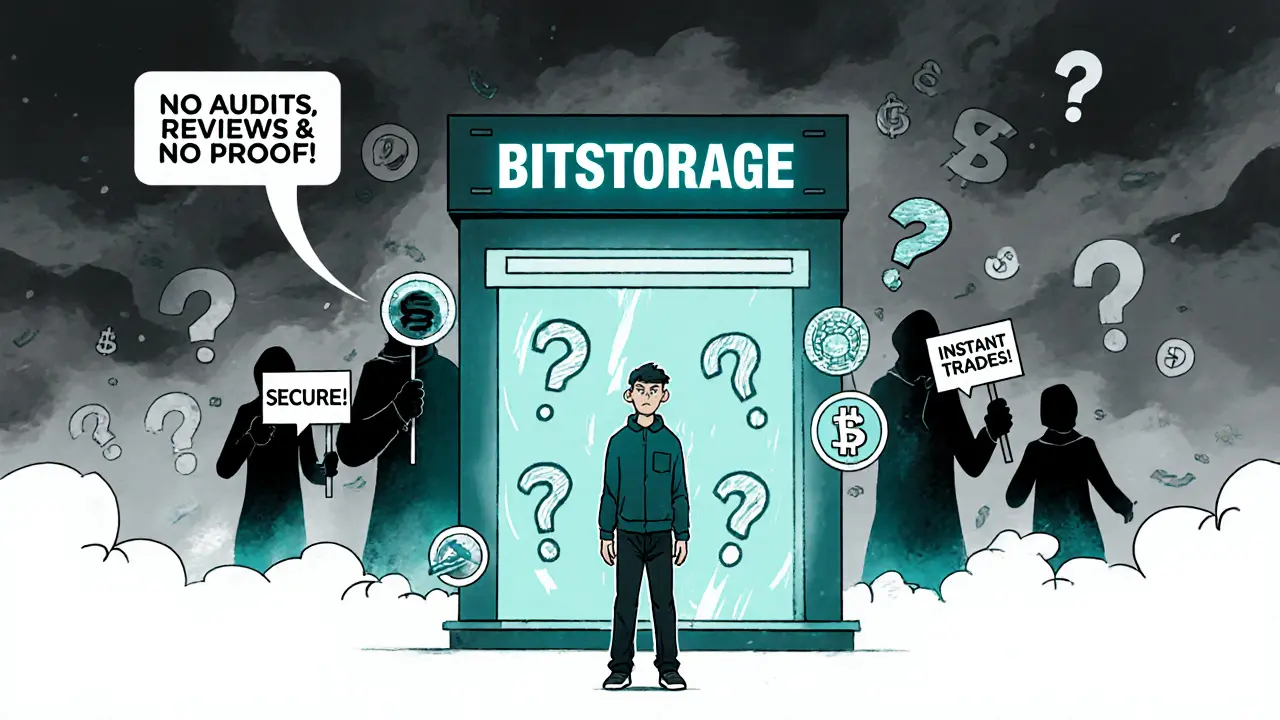

BitStorage Crypto Exchange Review: Features, Security, and What You Need to Know

- 10 Comments

- Aug, 2 2025

BitStorage is a crypto exchange with over 500 coins and staking features, but lacks independent reviews, security audits, or user feedback. Proceed with extreme caution - no proof means high risk.

SushiSwap V3 on Arbitrum: A Real-World Review for Crypto Traders

- 6 Comments

- Aug, 2 2025

SushiSwap V3 on Arbitrum offers lower fees and unique rewards for liquidity providers, but it's complex and less liquid than Uniswap. Ideal for experienced DeFi users seeking yield, not beginners.